Elevate Your Collections with AI Decisioning: The Future of Debt Recovery

Debt recovery is often seen as a necessary, yet challenging, business

function—one that has the potential to strain customer relationships. But what

if debt recovery could be both effective and empathetic, yielding better

results for your business while maintaining positive connections with your

customers? At Instellars, we’ve turned this vision into a reality by

partnering with leading organizations to transform their collections processes

using AI-driven solutions. This blog delves into real-world experiences and the

business outcomes we’ve delivered, reshaping debt recovery for the modern

enterprise.

Turning Challenges into Opportunities: A Real Client Experience

One of our clients, a leading financial institution, faced significant

challenges with their collections process. Their traditional methods relied on

standardized approaches, which often resulted in alienating customers,

prolonged recovery times, and high churn rates. They needed a solution that

would not only improve recovery rates but also retain customer trust and

loyalty.

Our AI-powered collections solution offered them a fresh perspective. By

integrating risk assessment with advanced AI decisioning, we helped the client

tailor their collections strategies to the unique situations of each customer.

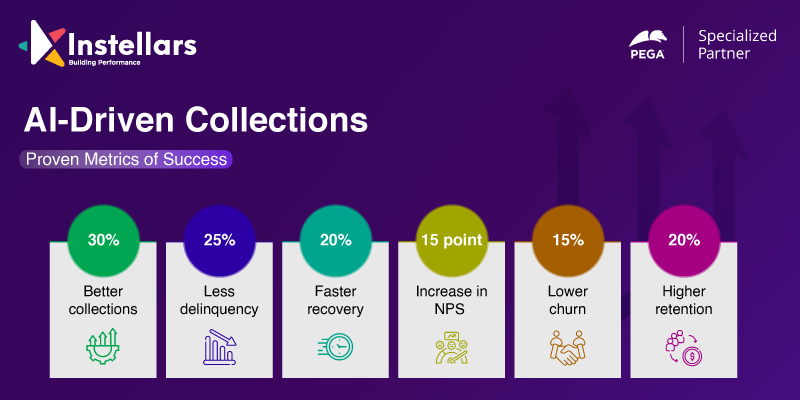

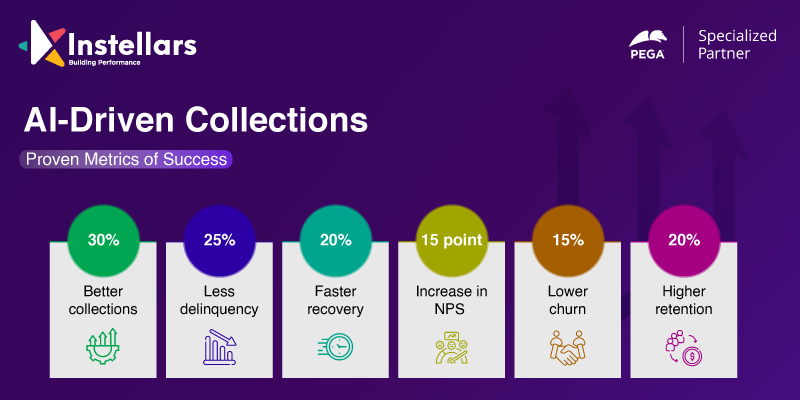

The results were immediate and impactful. Within just six months of

implementing our solution, the client saw:

- A 25% reduction in delinquency rates.

- A 30% improvement in collection rates.

- Customer satisfaction (NPS) scores improve by 15 points.

These numbers tell only part of the story. The true outcome was the long-term

trust we helped our client rebuild with their customers, converting delinquent

accounts into loyal, engaged customers.

Merging Risk Management with Empathy Through AI

In every debt recovery journey, the key lies in balancing the need for timely

recovery with the need to maintain a positive customer relationship. Our

solution bridges this gap by merging risk management with empathy. Using AI to

analyze customer data, we helped another client, a telecom giant, identify and

categorize customers based on their financial risk levels.

The AI engine flagged vulnerable customers early in the cycle, allowing the

client to offer personalized payment plans and restructuring options before the

customers defaulted. This early intervention not only prevented debt escalation

but also enabled the client to foster goodwill and trust among its customers.

Over 18 months, this client saw a remarkable shift in their collections and

customer retention:

- Recovery times reduced by 20%.

- Churn rates fell by 12%, as more customers chose to stay with the

brand.

- Customer retention increased, with delinquent accounts converting to

loyal, long-term relationships.

This isn’t just about numbers—it’s about fundamentally transforming how debt

recovery works by putting the customer at the center of the strategy.

Empowering Agents and Customers: The Digital-First Approach

One of the biggest wins for our clients comes from empowering both their agents

and their customers through our digital-first approach. For one financial

services provider, traditional collections methods were slow, manual, and

frustrating for both customers and agents. Agents were overloaded with cases,

while customers were often left waiting for responses and resolutions.

With our solution, we implemented self-service portals and automated workflows,

allowing customers to manage their accounts, set up payment plans, and

communicate directly with the organization—all at their convenience. Agents,

meanwhile, received real-time AI-driven insights and recommendations, enabling

them to handle complex cases with confidence and agility.

The results were transformative:

- Agents’ productivity increased by 40%, allowing them to focus on

high-value interactions.

- The number of cases resolved through self-service increased by 35%.

- Customer complaints dropped by 20%, with satisfaction rates improving

significantly.

This digital-first transformation not only streamlined operations but also

created an effortless experience for both agents and customers, ultimately

driving better business outcomes.

Anticipating Customer Behavior with Pega CDH

A critical factor in our success is leveraging the Pega Customer Decision Hub

(CDH) to anticipate and predict customer behavior. For a leading bank we worked

with, the challenge was not only recovering debt but doing so in a way that

nurtured long-term relationships. They needed to know what actions would

trigger a positive response from their customers, especially in delicate debt

situations.

Pega CDH enabled them to predict how different segments of customers would

react to various offers, communication strategies, and repayment options. This

foresight allowed the bank to personalize every interaction, from the timing of

outreach to the tone of the communication. As a result, they not only increased

their recovery rates but also achieved:

- A 15% improvement in customer retention.

- A 10% boost in long-term customer loyalty.

- More than 20% of previously delinquent accounts returned to active status

within one year.

Transforming Debt Recovery into a Customer-Centric Process

The overarching theme of these experiences is that debt recovery is no longer

just a process of collecting overdue payments—it’s about transforming every

customer interaction into a positive, trust-building moment. At Instellars,

we’ve proven time and again that with the right technology and a

customer-centric approach, businesses can recover more, reduce risk, and create

long-lasting customer relationships.

One of the most compelling outcomes we’ve delivered is the transformation of a

traditionally negative experience—debt recovery—into one that leaves customers

feeling understood and respected. Our clients, spanning industries from finance

to telecom, have consistently seen improvements in key business metrics,

including:

-Faster recovery times, reducing collection cycles by up to 20%.

-Higher customer satisfaction: Across our clients, Net Promoter Scores (NPS)

improved by an average of 15 points.

- Lower churn rates, as customers who might have otherwise left the

brand remained loyal.

- Increased customer retention, turning delinquent accounts into active,

engaged customers.

Conclusion

The future of debt recovery is clear: It’s no longer just about collecting

overdue payments; it’s about driving value through every customer interaction.

By leveraging AI-driven decisioning, empowering agents and customers alike, and

taking a predictive, customer-first approach, we’ve helped our clients not only

recover debt but also foster stronger relationships and improve their bottom

line.

Ready to transform your debt recovery process? Contact Instellars

today and discover how our AI-powered, customer-centric solutions can help you

recover more, reduce risk, and achieve sustainable success.

The transformation that matters

Send your resume to Careers @ Instellars